sales performance of the future for banks and insurers

How digitalization is changing the way the financial industry commercializes its products

Digitalization is radically changing the financial world, and banks and insurers are going through a process of disruption. In addition to fintechs, established organizations compete with high-tech companies such as Apple, Google, and Amazon. These are slowly penetrating into the field of financial services, posing a threat to traditional banks, and finding a hearing especially among young customers.

Furthermore, specialized comparison portals such as Check24 and Interhyp are also revolutionizing the financial scene while confirming that technology has boosted the rise of a new customer need: empowerment.

Empowerment within the financial industry means enabling customers to search for, learn about, buy, and manage their own financial products by themselves. Robo advisors, chatbots, and video consulting are also new technologies in the financial scene that are revolutionizing the commercialization of financial products by enabling customers to “sort things out” by themselves. The consequence of this phenomenon, however, is a profound change in the role of banks and insurance agencies.

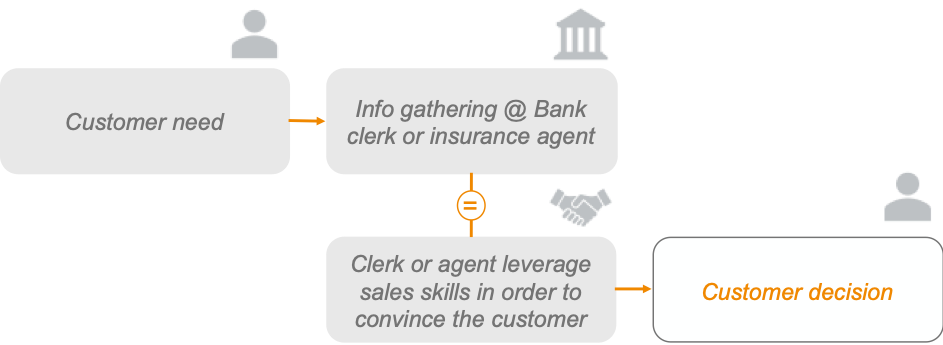

We have always been accustomed to experiencing many touchpoints of financial transactions taking place through personal interaction between bank clerks or insurance agents and their customers. Now, to a certain extent, technology has taken over the role of these advisors since customers are now enabled to take care of many more things by themselves.

Let us be concrete and give an example. A customer needs a new credit card from their bank. Twenty years ago, to subscribe to a credit card, the customer would have planned a personal meeting with a clerk to obtain all the necessary information about the bank’s products. If the clerk were a good salesperson, they would also have used the same conversation with the customer to try to understand and leverage possible additional customer needs for up-selling and cross-selling.

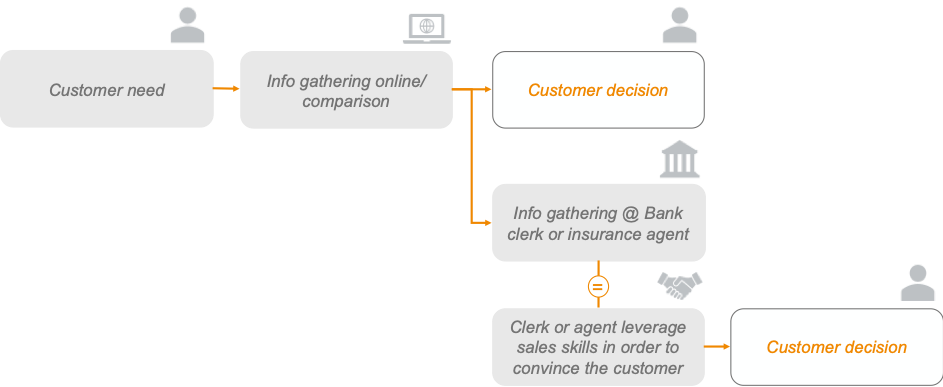

These days, who would think of going straight to a bank without having a clue at all on the products? It's much easier to go online and compare different financial products on a portal like Check24. In Germany, 9 out of 10 customers claim that the first thing they do when buying a financial product is to first get as much information as possible about product alternatives on the web.

This new customer tendency of “getting information by themselves” has an enormous impact on bankers and insurance agents. Indeed, the awareness creation step of customer journeys is turned upside down since clerks and agents are no longer the customer’s “main source of information.”

Using digital applications and comparison portals, customers first becomes aware of their needs and possible solutions online, and ONLY AFTER they have understood the topic thoroughly and are convinced by the solution of one or a few specific providers do they turn to a physical person (from the selected providers) for further information. However, when they do so, they do it with a certain degree of knowledge about the topic and a clearer picture in mind of what they need.

Even though end-to-end online experiences and comparison portals have proven very successful, clear, transparent and catchy, they have are still not able to surpass human skills when it comes to sales performance (and probably never will).

As a matter of fact, today’s insurers and banks are still highly dependent on their sales forces—the key to getting customers’ signatures on contracts.

In the German retail financial market, agents and clerks work with a large customer portfolio to which they are bound by long-term personal relationships and trust, and they are often offered a highly competitive compensation model based on annual commissions derived exactly from this existing customer portfolio. This means that they receive considerable bonuses and a comfortable life with relatively little need for developing new business because their existing customer portfolio is already a “cash cow.”

In summary: Yes, new technologies are revolutionizing customer journeys in the retail financial world, but as of today, these changes are neither fast enough nor effective enough to pose a real threat to the role of clerks and agents, who are still surviving (if not thriving) more than comfortably and making large profits from their existing portfolios. However, how long will this stagnating situation last? And what should the role of clerks and agents be in the future?

From our work with financial service providers and end-customer surveys, rpc has derived three main takeaways that will determine the success of insurers and banks in the future:

Financial products will never be totally straightforward for all customers

Technology has a disruptive effect on the financial industry and reduces complexity, but the product landscapes of banks and insurance companies have not been simplified at a comparatively fast pace. When we talk about insurance and banking products, what does the average inexperienced customer think about first? Probably, “I have no clue,” followed closely by “that's too much information that I don't understand.” Most financial products are by default complex products that can be simplified only to a certain extent. Technology can make customer journeys in the financial industry easier, but it is important to remember that financial products will never be as easy to understand as buying a ride on Uber.

The higher the complexity, the more likely customers will need human support

Although customers seem increasingly open to buying simple and straightforward financial products without human interaction via websites, apps, or even chatbots, one truth remains: The more complex the product, the more likely it is that the customer will feel more comfortable turning to a human expert if they need assistance.

Agents and clerks will survive technology only if they leverage their strongest weapon: the human factor

The role of agents and clerks will shift from a commission-driven salesperson to a customer-focused coach who supports the client in their real needs and who finds a solution to their concerns. We at rpc believe that the role of the clerk and agent will not disappear in the near future. But, in order for them not only to survive in the future, but also to thrive, sales people must leverage the human factor as the only key to achieving higher sales performance and personal relationships (something machines cannot do) and at the same time become more attractive for future generations, who, despite being “digitally native,” very much welcome being helped by a human being in case of overwhelming complexity

rpc has developed an entire portfolio to ensure an increase in sales performance within the retail financial services organization, genuine customer-focused advising, and radical behavioral changes on the part of bankers and insurance agents to grant the above-described role shift from salesperson to coach.

In the next article, we will delve deeper into the needs of millennials when it comes to financial products and services. So, stay tuned! If we have already piqued your curiosity, please do not hesitate to contact us.